How to Earn: 100,000 QFF Bonus Points with Qantas Assure (Private Health Insurance)

Often a burden to many people in Australia, Private Health Insurance has become one of those non-negotiable expenses we incur in life. To make matters worse, we often get hit with an annual increase, with no added benefits.

I stumbled across Qantas Assure about a month ago; they are a Private Health Insurer, underwritten by NIB Australia. At the time I signed up (late March 2018) they were offering 120,000 QFF points on sign to a couples Top Hospital Cover + any added Extras Cover. The points are rewarded after holding the policy for 60 days. The same process can be applied to single cover, but you would only receive 60,000 points, which is still rather handy.

My first thought was that they clearly were offering this and likely recouping costs in the actual premium. However, I was quite mistaken. As it stands I pay a monthly premium of $90. My partner was also paying a similar amount. I put through a quote for Top Hospital Cover, along with the cheapest Extras Cover and this came to a total of $325 per month for both of us. This being a difference of $145 per month, over 2 months.

So come the end of May, I should be credited with 120,000 points at a cost of $290, and I can then choose to cancel my cover and go back to my normal provider, which I will likely do.

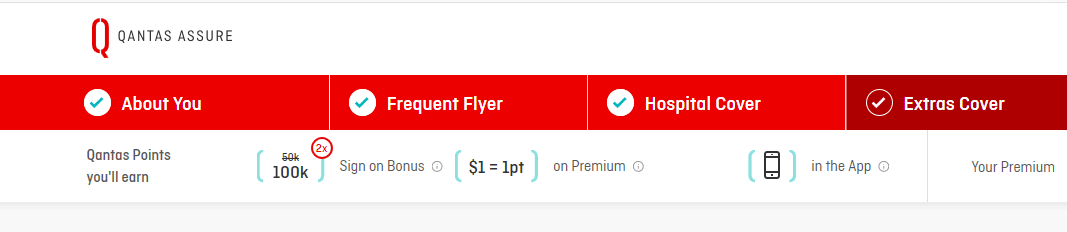

It’s worthy to note that since I discovered this deal, the offer has changed 2 times. It is currently sitting on 100,000 for top hospital and extras. However, I expect this to change again and get better again, closer to the end of financial year. I encourage everyone to just monitor the home page on a monthly basis to see what the current offer is.

Current Offer Terms:

Qantas Frequent Flyer (QFF) members who purchase a Qantas Assure (QA) Health Insurance policy between 25/04/18 and 11:59pm AEST on 07/05/18 will earn double sign on Qantas Points. 100,000 is the maximum number of sign on Qantas Points that can be earned upon purchase of combined Top Hospital and Top Extras Cover for Couples or Families. Each QA Health Insurance policy has a maximum number of points that can be earned upon purchase, which can be found here. Points will only be awarded to the primary policyholder after the policy has been held for 60 continuous days and will be based on the level of cover held at that time. Not available to existing Qantas Assure, nib, AAMI, Apia or Suncorp customers, or to previous policyholders who have joined and cancelled 6 months before or during the offer period. Qantas reserves the right to withdraw or extend this offer at any time.

Some take home notes is that whilst it worked out to be beneficial for me, it might not work in favour for everybody’s current position, but if definitely doesn’t hurt to compare with what you are currently paying. It also appears that once you have not held cover with them for more than 6 months, you will be eligible to apply again and obtain the bonus.

Positives

- Offers an alternative to applying for Qantas Credit Card Deals to get points in high quantities.

- Getting Something in return for holding Private Health Insurance

- Generous 60 day period to get points

- Access to Qantas Assure App which lets you earn bonus QFF points based on exercise.

- Overall cost works out to be roughly the same compared to an Annual Fee on a Credit Card offer.

Negatives

- Amounts will vary between age and location of every user.

- Time involved cancelling policies of insurance

- Deal changes on a Monthly basis

- Have to hold, at a minimum, top Hospital cover for 2 months.

In Summary, this deal provides access to another way of accessing QFF points in a high quantity, without taking a hit on the credit file. I will hopefully review this every 6 months and will look to take advantage where possible.